What is a Commodity Swap?

What Is a Commodity Swap: Unraveling the Secrets of Trading

In the bustling world of finance and investment, where stocks, bonds, and derivatives dominate conversations, there’s a lesser-known player that deserves our attention: the commodity swap. If you’re new to the trading scene or simply seeking to expand your knowledge, this article aims to demystify the concept of a commodity swap, shedding light on its intricacies and potential benefits.Understanding the Basics

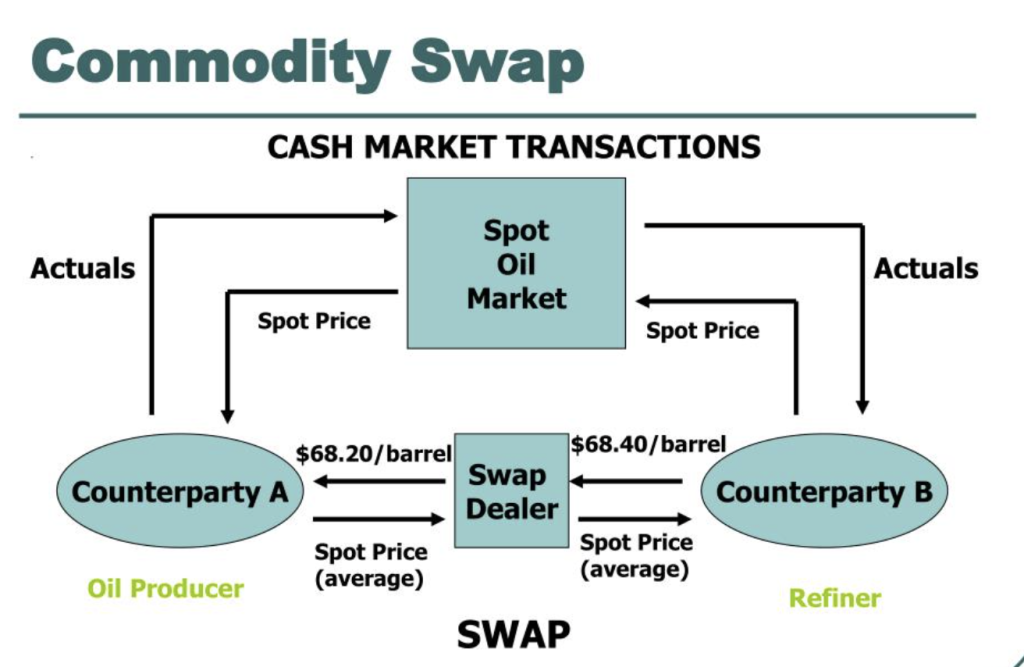

Before diving into the depths of commodity swaps, let’s establish a foundation by defining what they are. At its core, a commodity swap is a financial agreement between two parties to exchange the cash flows derived from a particular commodity. Unlike physical trading, where actual goods change hands, a commodity swap allows traders to capitalize on price fluctuations without the hassle of dealing with physical delivery. For instance, imagine you’re a coffee enthusiast and firmly believe that the price of coffee beans will rise in the near future due to weather conditions affecting production. Instead of physically buying coffee beans, a commodity swap would enable you to enter into a contract with another party. In this contract, you agree to exchange the difference between the current price of coffee beans and the future price at a specified date. If your prediction proves correct and coffee prices soar, you’ll profit from the price difference, regardless of whether you physically own coffee beans or not.

The Mechanics Behind Commodity Swaps

Now that we’ve established the essence of a commodity swap, let’s delve into the mechanics that make this financial instrument tick. A commodity swap typically involves two parties: the “fixed-rate payer” and the “floating-rate payer.” The fixed-rate payer agrees to pay a predetermined fixed price for the commodity, while the floating-rate payer agrees to pay a price that fluctuates based on market conditions. For example, consider a scenario where you’re the fixed-rate payer in a commodity swap for crude oil. You agree to pay $60 per barrel of oil, regardless of whether the market price rises or falls. Meanwhile, the floating-rate payer agrees to pay a price that aligns with the current market rate of oil. If the market price rises to $70 per barrel, you’d profit from the $10 difference, which the floating-rate payer would compensate you for.Benefits and Risks